Where Is The Singapore Industrial Property Market Heading in 2023?

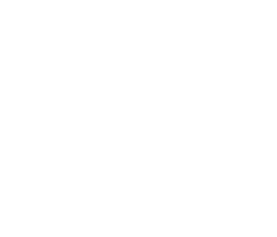

In the year end of 2022, all industrial price and rental indices continued moving in an upwards momentum. In 4Q 2022, all industrial price and rental indices rose by 1.7% and 2.1% quarter-on-quarter (qoq) respectively. This marks the ninth consecutive quarters of increase since 4Q 2020.

Source: JTC, ERA Research & Market Intelligence

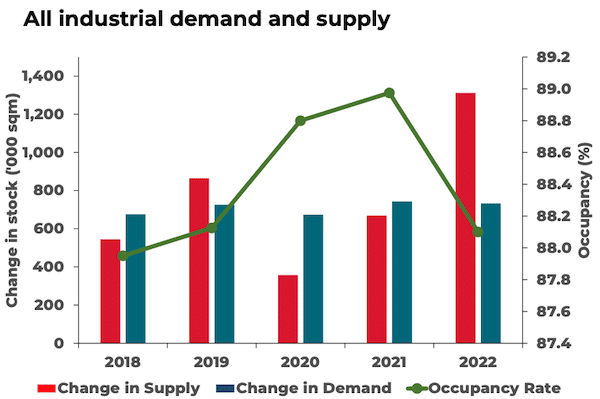

Multiple-user and Single-user Factories

*Occupancy rates based on the average of both multiple-user and single-user factories. Source: JTC, ERA Research & Market Intelligence

In 4Q 2022, the price index for multi-user factory rose by 8.7% year-on-year (yoy), higher than the increase in single-user factory of 5.7% yoy. Factory prices held up considerably well despite a large increase in factory supply. At the tail-end of 2022, the net supply of factory space increased by 496,000 sqm. The increase in net supply is significantly higher than the pre-pandemic average of 100,000 to 200,000 sqm of factory space from 2018 to 2022. Even with more available factory spaces, there was minimal downwards pressure on both the price and rental indices.

This indicates that there is increasing demand from local and foreign businesses seeking high-quality factories that can accommodate multiple users. However, due to a weakening outlook for the manufacturing sector, demand may slow down to a marginal growth. Nonetheless, as Singapore remains the port of call given its political stability, favourable business policies and strong currency, may attract more firms to set up their manufacturing centres in Singapore.

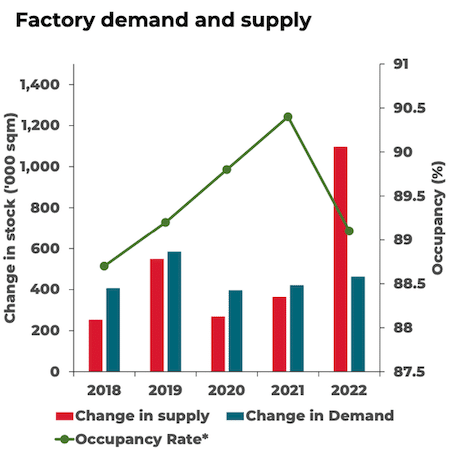

Warehouse

Source: JTC, ERA Research & Market Intelligence

The rental index for warehouse spaces is on a bullish trend due to limited supply and a growing need for such spaces. Warehouse rentals grew by 7.9% yoy in the last quarter of 2022. Among the other industrial spaces, warehouse is poised for further growth as one of the better performing industrial spaces come this year. The need for warehouse space remains high, as it is supported by a range of end-users such as e-commerce, third-party logistics providers, and food manufacturers. As escalating tensions between US-China continues brewing amidst the Russia-Ukraine war, we may observe an increase in stockpiling activity thus supporting the demand for warehouse spaces.

Business Parks

Source: JTC, ERA Research & Market Intelligence

In 2022, there was a substantial 85,000 sqm increase of net business park supply. Even with the increase in stock, business park rents managed to marginally increase by 1.0% qoq in the last quarter of 2022. Due to an increase in supply and muted demand, particularly from the slowdown in tech industry this year, leasing activity may soften.

However, we believe that there may be demand for business parks situated in prime locations such as One-north. Some companies may prefer such locations due to enhanced accessibility or agglomeration benefits with similar firms in the precinct.

Top Industrial Deals in 2022

Based on our list of highest transacted industrial deals in 2022, it is no surprise that freehold industrial spaces are able to command a price premium based on land rate ($psm). For a freehold property, the landlord does not need to apply for a lease renewal nor do they need to top up a premium to extend the tenure.

According to land rate, freehold industrial properties like Lam Chuan Building was sold at a significantly higher land rate of $19,053 psm than the rest.

Source: JTC, ERA Research & Market Intelligence

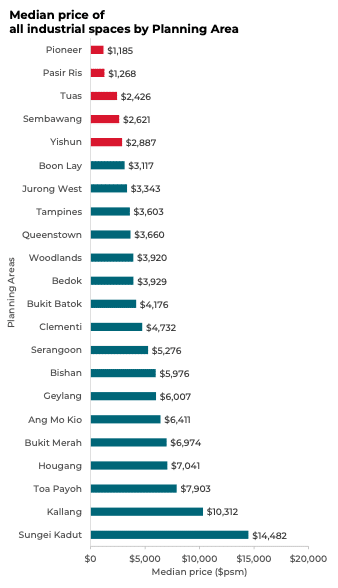

Potential Demand for Affordable Industrial Spaces

Conclusion

The industrial sector can expect to receive a sizeable amount of upcoming supply in 2023 and 2024. The substantial increase in supply may exert some downwards pressure onto the price and rental rates of industrial properties in Singapore. In addition, the industrial property sector may continue to face some headwinds due to a pullback in manufacturing and technological industries.

However, we believe that demand from both local and foreign companies will remain present in the market. Singapore stands as a strong transhipment hub for warehouse and production space. An expansion in other sectors such as FCMG and E-commerce may help bolster some of the weakening demand in the tech sector. Against the backdrop of escalating global tensions, Singapore’s real estate sector will be regarded as a safe haven with its track record of a sustainable property market and strong currency.

Nonetheless, we believe that the more measured growth in prices and rental rates could be an opportune time for astute investors to tap into the Singapore’s industrial market.

Written by: ERA Research & Marketing Intelligence, ERA Singapore

Date Published: April 2023

If you are an investor looking to purchase industrial property, please feel free to contact us at ask@officespaces.com.sg, our consultants will be able to assist you in your investment journey.